Restricted Stock Unit

A Restricted Stock Unit (RSU) is a form of stock based compensation that:

- will vest at some point in the future

- will have some value upon vesting (unlike stock options)

- is based on the value of the company's stock

- will vest at some point in the future, likely based on time passed or perhaps the achievement of a goal. They are then distributed as stock.

- (until vested) are nothing more than an unfunded promise to issue shares of stock to the recipient at some point in the future.

The value of your RSU award is equal to the current stock price multiplied by the total number of units granted to you.

The recipient of RSUs should be clear on:

- What causes the RSUs to become vested? A certain period of time or an employee's achievement of a goal or milestone.

- What happens to the RSUs if specific events such as termination, retirement, or death of the employee occur?

- What happens to the RSUs in the event of a change in control of the company?

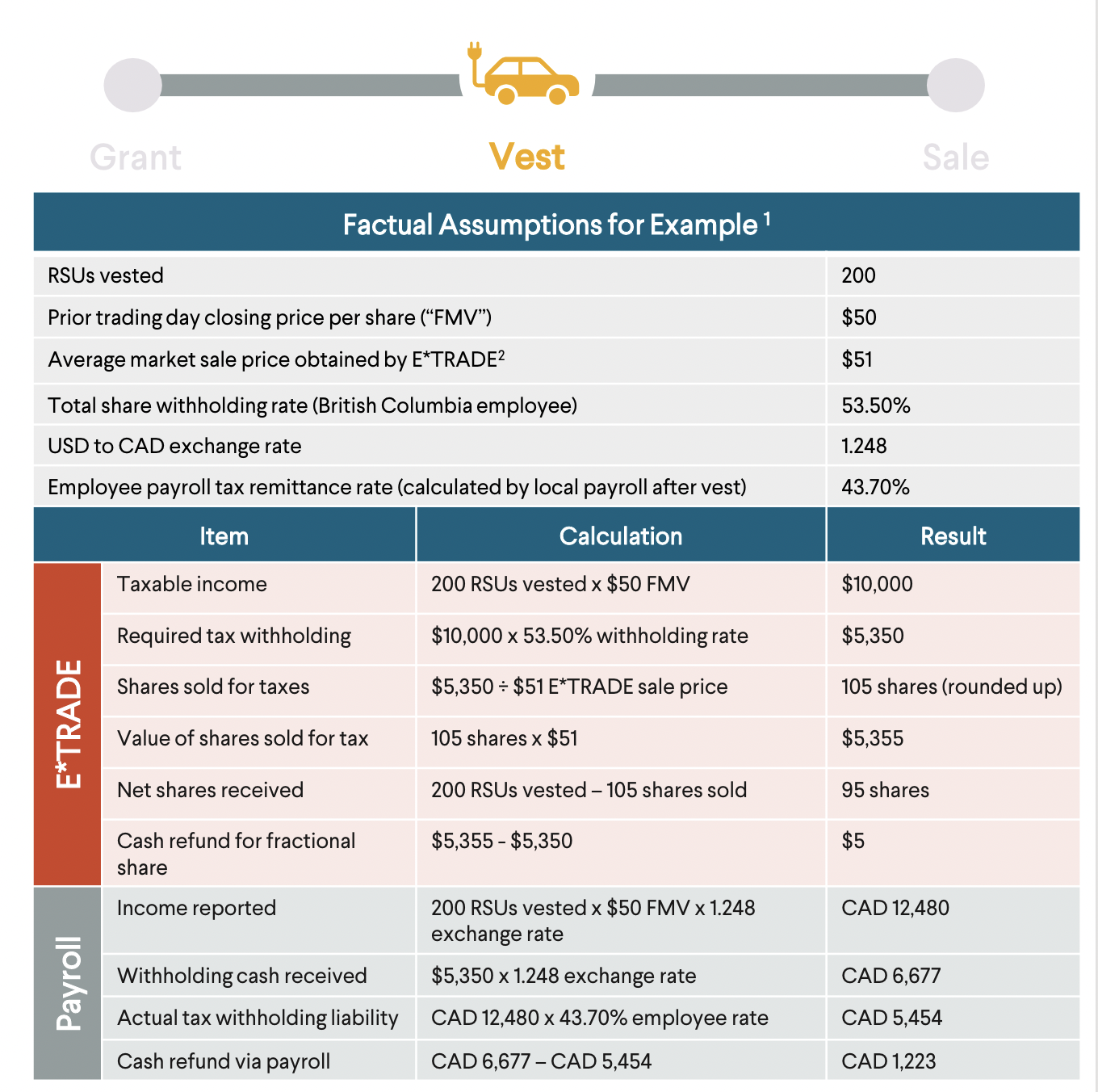

- How are taxes withheld when the RSUs vest?

Consider that continuing to hold the resulting shares after the vesting period is virtually the same as buying at the top of the market in expectation that the price will continue to rise. This may or may not be what you would do if you were an outsider just buying the company's stock on the public exchange.

- One thing is certain: if you would not buy the stock as an outsider, then you should probably sell your shares.

- It is wise to think of the RSUs as a cash bonus; the decision is whether to “buy” company stock or invest it elsewhere to diversify.

unlike stock options, the vesting event for RSUs is a taxable event.

- that is, when the shares vest and you as the employee have earned them, you must pay tax on them.

- ex. if you are awarded $20,000 annually, that amount will be added onto your taxable income. To cover the amount of tax that will correspond to this RSU value, the employer will probably sell some of the shares.

Like stock held in any other non-registered account, the sale of RSUs is subject to capital gains tax.

- Your "cost basis" for any individual share from RSUs will generally be equal to the FMV of the stock for tax purposes at vesting, but special cost basis tax rules apply where you have acquired shares from RSUs at different times.

Example: