Economics

Motivation crowding theory

def - Intrinsic motivation for a particular task can be undermined if money is offered to do the job

Economy -> market -> transaction

Getting credit is just a transaction of money for interest

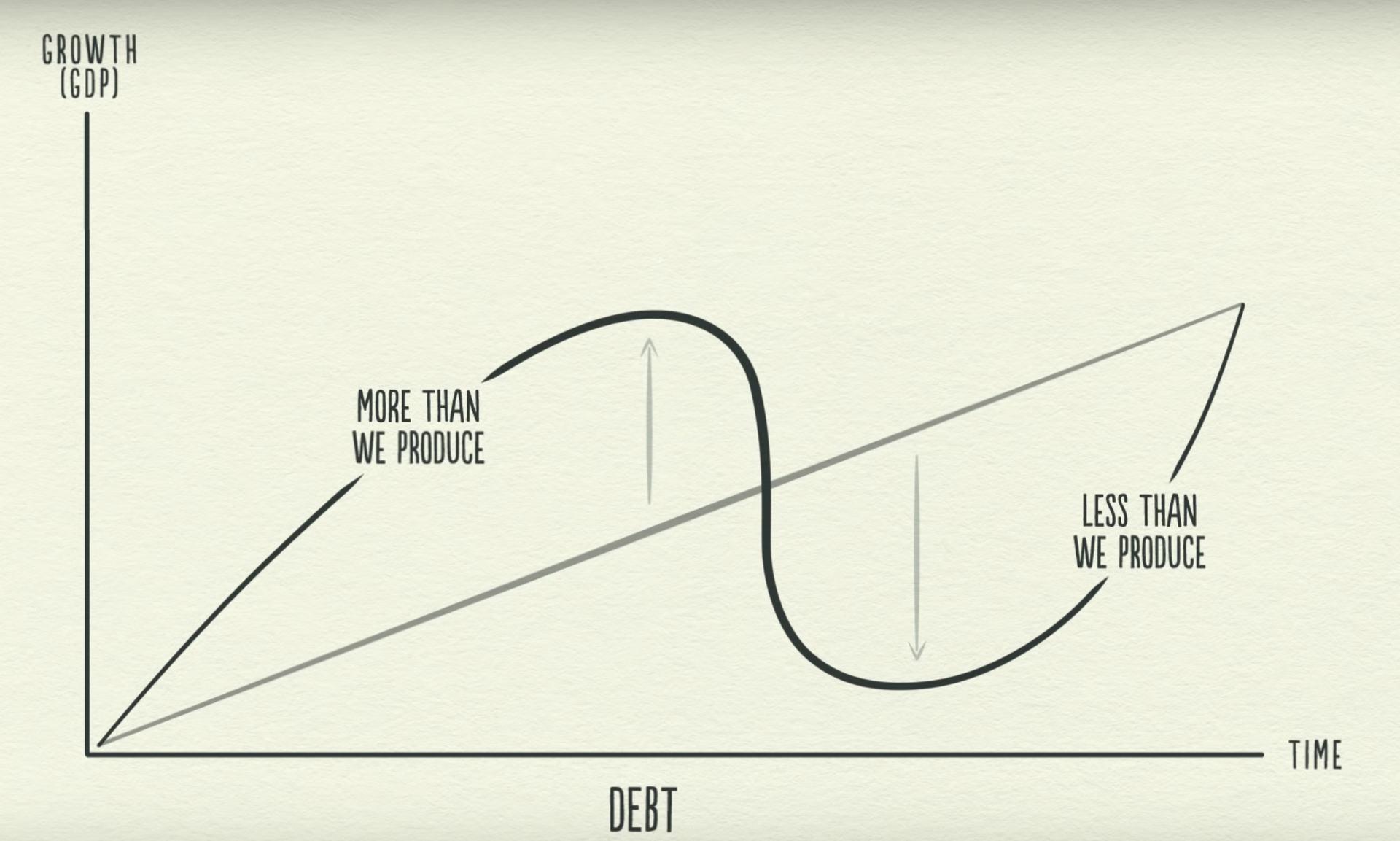

Economic cycles are created because of debt. Without debt there are no cycles

- borrowing money today means I can spend more today, but will have less to spend in the future. This is what creates the cycle

credit it one of the most important to pay attention to, since it is the biggest and most volatile

as interest rates are low, more people seek to borrow the cheap money. This causes people to spend more. This increased spending, results in an increase in overall income, and someone elses quality of life increases.

- When someone's income rises, it makes them more attractive for getting loans (creditworthy)

- Therefore, as income rises, borrowing typically rises, which leads to more spending. This creates a cycle that impacts the entity that received your money, and so on. (See below image)

- This results in economic cycles

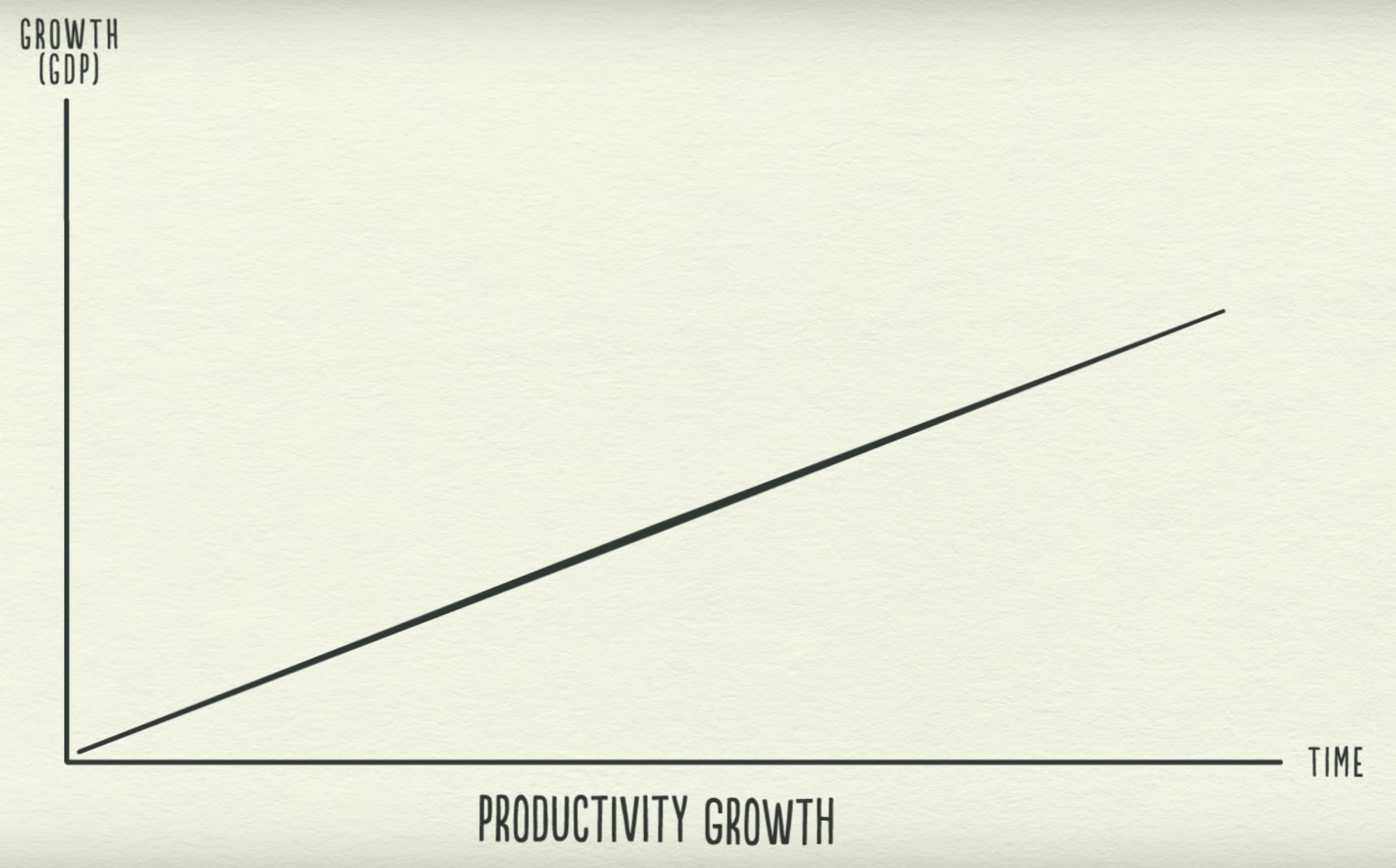

As entities (corporations/people) age, the good ones learn how to advance further and use experience/knowledge to make more money. Put another way, they produce more, so they can charge more for their productivity hours.

- This is productivity growth

- productivity growth doesn't fluctuate much over time, making it more important over the long run, and less so over the short run.

On the other hand, because credit is so volatile, it matters most in the short run. In other words, it is a big driver of economic swings.

- This is because when we have more freely available credit, we consume more. Conversely, when we have less available credit and have to pay back the debt, we consume less

The supply of a currency will rise as a result of increasing demand in that currency

- expl. as demand for the $USD increases, the price will be driven up and the federal reserve will print off more money to meet that increased demand.

- "Bitcoin is the first commodity in the universe where supply does not follow demand" —Winklevoss

when the government prints off money, there are a few places that the government can inject the money into the economy

- it can go to the government, which is debt monetization (or the nationalization of debt

- If both depositors and borrowers get it — depositors through higher interest rates and borrowers through lower interest rates — then it’s called dual interest rates

- it can go to the lenders, which is quantitative easing

- it can go to the people, which is helicopter money

How did negative oil prices happen?

Imagine if the price of a commodity were to so low, that traders did not want to sell it, instead desiring to store it for future sale. Because availability of storage is so inelastic, such a scenario can lead to a gnarly game of musical chairs. And that’s exactly what happened on April 20th 2020, a month into the U.S. Covid-19 pandemic lockdown. Demand for oil dropped so precipitously that oil holders suddenly found themselves scrambling for storage depots. When storage ran out, those still holding barrels had no choice but to pay people to take their oil, causing the price of oil to go negative. Yes, really, the West Texas Intermediate oil benchmark closed at -$37.63.

In every recent recession there has been a permanent loss in jobs

- ex. In the Covid pandemic, when productivity return to pre-Covid levels, there was overall less amount of hours worked, meaning that there was a permanent loss of jobs, given the same level of productivity

Children